When investing in precious metals, two main paths often emerge: bullion and numismatic coins. While both options have their unique advantages, the right choice for you depends on your financial goals, risk tolerance, and investment strategy. This guide will break down the key differences between bullion and numismatics, their investment potential, and how to find the best deals on each using Bullion Hunters, the ultimate platform for comparing precious metals prices.

What Is Bullion?

Bullion refers to precious metals like gold, silver, platinum, and palladium in their rawest investment form, typically as coins, bars, or rounds. Bullion derives its value primarily from its metal content and the spot market price, making it a straightforward investment for wealth preservation.

Benefits of Investing in Bullion:

- Simplicity: Easy to buy, sell, and trade, as its value is tied directly to the spot price.

- Liquidity: Bullion is universally recognized and easy to convert into cash.

- Portfolio Stability: Acts as a hedge against inflation, economic instability, and currency fluctuations.

Popular Bullion Options:

- Gold Bars: Available in various weights, offering flexibility for investors.

- Silver Coins: Like the American Silver Eagle, valued for their metal content and liquidity.

- Platinum and Palladium Bullion: Gaining traction for industrial use and diversification.

What Are Numismatics?

Numismatic coins are collectible coins that derive their value from factors like rarity, historical significance, condition, and demand, in addition to their metal content. Numismatics often appeal to collectors and long-term investors looking for unique items with growth potential.

Benefits of Investing in Numismatics:

- Rarity Premiums: Rare coins often increase in value over time due to limited supply.

- Historical Appeal: Coins with historical significance attract collectors and enthusiasts.

- Diversification: Adds variety to a portfolio, reducing reliance on spot price fluctuations.

Popular Numismatic Coins:

- Saint-Gaudens Double Eagles: Known for their exquisite design and historical importance.

- Morgan Silver Dollars: A collector’s favorite with enduring demand.

- Limited Edition Coins: Unique designs and low mintage make these coins standout investments.

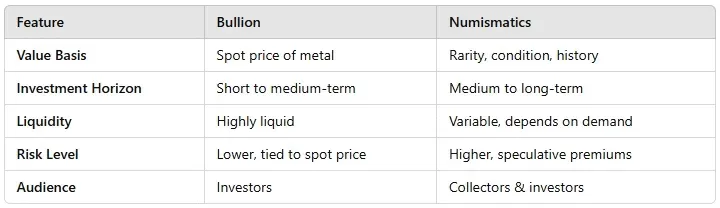

Bullion vs. Numismatics: Key Differences

Which Investment Is Right for You?

Choosing between bullion and numismatics depends on your objectives:

Bullion is ideal for:

- Those seeking to hedge against inflation or economic uncertainties.

- Investors looking for simplicity and high liquidity.

- Beginners entering the precious metals market.

Numismatics is ideal for:

- Collectors passionate about history and unique designs.

- Long-term investors aiming to profit from rarity premiums.

- Experienced investors diversifying their portfolio.

How to Find the Best Deals on Bullion and Numismatics with Bullion Hunters

Bullion Hunters is the go-to platform for comparing prices on bullion and numismatic coins. With real-time updates from top dealers, you can find competitive prices and special deals on high-quality products.

Why Use Bullion Hunters?

- Comprehensive Comparisons: Compare prices on gold, silver, and rare coins across multiple trusted dealers.

- Convenience: Access up-to-date pricing on a single platform.

- Exclusive Deals: Discover promotional offers and discounts on bullion and numismatics.

- Trusted Sources: All listed dealers are vetted for quality and reliability.

Whether you’re searching for investment-grade bullion or rare collectible coins, Bullion Hunters simplifies the process, saving you time and ensuring you get the best value.

Choose the Right Path for Your Goals

Both bullion and numismatics offer unique opportunities for investors and collectors. Bullion provides a reliable way to safeguard wealth, while numismatic coins offer the excitement of collecting and the potential for long-term value growth.

No matter which path you choose, Bullion Hunters is your trusted partner in finding the best deals and maximizing your investment. Start exploring today to secure your financial future with confidence!

Another article that may interest you:

Celebrate the 2025 Year of the Snake with Precious Metals