December 11, 2025

Silver’s Surge and the Beginning of a New Price Era

Silver’s powerful climb past $63 per ounce has reignited global interest in how far the metal could rise as demand accelerates worldwide. Predictions of triple-digit silver prices once seemed extreme, yet the rapid electrification of modern industry is forcing analysts to reconsider old assumptions. With renewable power expanding, electric vehicles reshaping manufacturing, and advanced electronics consuming more silver each year, the metal is becoming not just valuable — but indispensable.

At the same time, chronic supply deficits and limited mine growth suggest that silver may be entering an entirely new pricing regime. The central question for investors is now unmistakable:

Are traditional silver models missing the scale of demand coming in the next decade?

Why the Case for $300 Silver Is Gaining Traction

The argument for a massive revaluation of silver is no longer hypothetical. It rests on visible, data-driven shifts in global consumption — particularly in four rapidly expanding sectors.

1. Solar Power Demand Is Accelerating Faster Than Expected

Solar energy is now the dominant force in global renewable expansion, and silver remains essential to photovoltaic (PV) production. Because no alternative metal matches silver’s unmatched conductivity, manufacturers have little room to substitute.

Key trends include:

- Solar installations could more than double by 2030.

- PV production is consuming record-high volumes of silver even as thrifting efforts level off.

- Several industry forecasts show solar demand alone could eventually outpace annual mine supply.

As nations push toward net-zero targets, solar power could become the single largest industrial consumer of silver worldwide.

2. Electric Vehicles Are Quietly Transforming Silver Demand

Electric vehicles require two to three times more silver than traditional combustion-engine cars due to the metal's crucial role in:

- battery electrical systems

- high-voltage components

- onboard electronics and safety sensors

- charging and energy-transfer interfaces

EV adoption is still in early stages, yet production already numbers in the tens of millions annually. The upward trajectory is clear: EVs will consume exponentially more silver in the coming decade.

If mining output continues to stagnate, the EV boom alone could generate persistent structural deficits.

3. High-Tech Electronics Depend on Silver’s Unique Capabilities

Silver is irreplaceable in modern electronics, including:

- AI servers and cloud-computing hardware

- semiconductor circuitry

- medical and diagnostic technologies

- next-generation 5G and 6G systems

- robotics and advanced automation

Because no competing material provides equal conductivity and reliability, this industrial demand is largely price-insensitive — it continues regardless of market volatility.

The global buildout of AI and data-center infrastructure could meaningfully increase baseline silver demand for years to come.

4. Silver Supply Deficits Are Expanding Every Year

Silver was in deficit even before electrification began reshaping demand. Now, those gaps are widening.

Today’s supply challenges include:

- stagnant or declining mine production

- aging deposits with lower ore grades

- limited exploration investment

- geopolitical disruptions in major producing regions

- shrinking above-ground stockpiles

When a critical industrial metal faces falling supply and rising consumption, prices often overshoot historical norms. That is the foundation of many $300 silver projections.

The Gold-to-Silver Ratio: A Signal That Silver Remains Undervalued

The gold-to-silver ratio (GSR) — the number of silver ounces equal to one ounce of gold — is one of the most reliable long-term signals of relative undervaluation.

Historically, the ratio has hovered between 40 and 60.

But even with silver trading above $63, today’s ratio remains well above 65.

This indicates:

- silver remains deeply undervalued relative to gold

- silver has not yet reflected its industrial demand surge

- the current rally could be the early stage of a much larger move

During previous metals bull markets, the ratio collapsed rapidly as silver dramatically outperformed gold. A return to historical norms — especially with gold above $4,200 — supports the possibility of triple-digit silver.

Why Forecasts Keep Missing Silver’s True Potential

Traditional price forecasts often underestimate silver because they treat it as just a monetary metal. In reality, silver is now:

- a monetary hedge

- a key energy metal

- a technological building block

- a critical component in national security systems

When industrial demand is added to investment demand, the baseline consumption could rise by hundreds of millions of ounces annually.

If silver supply deficits widen further — as nearly all models suggest — normalization alone could support silver at $150–$200. A supply shock or rapid investor accumulation could push it toward $300.

This isn’t hyperbole — it’s based on the arithmetic of supply and demand.

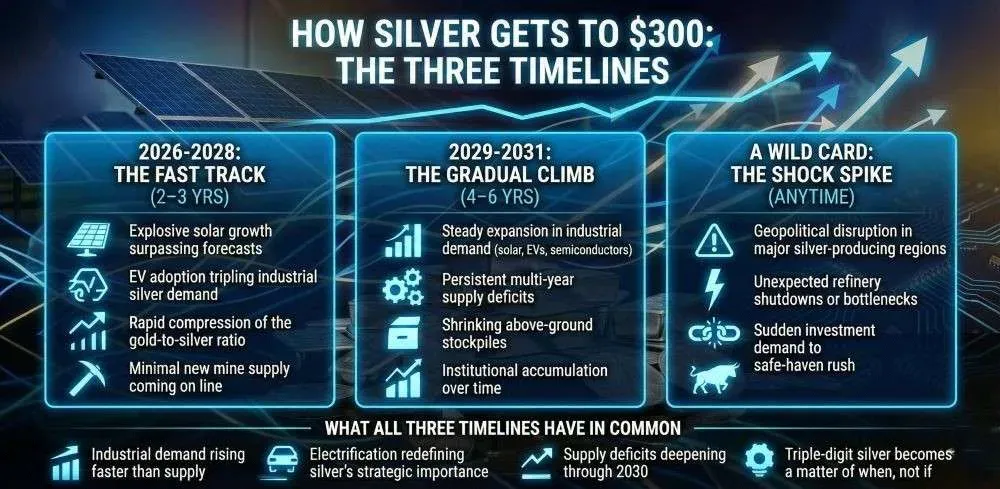

When Could Silver Realistically Reach $300?

While precise timing is uncertain, analysts generally outline three plausible scenarios:

1. Accelerated Scenario (2026–2028)

A rapid surge in electrification, solar expansion, and EV adoption reduces available silver far sooner than expected. If mine supply fails to respond and the GSR collapses quickly, silver could test triple digits within a few years and move toward $300 during a full commodity revaluation cycle.

2. Structural Scenario (2029–2031)

Industrial demand rises steadily but not explosively. Multi-year deficits deepen, stockpiles shrink, and long-term investment demand increases. Under this scenario, the spot price of silver climbs through $100 and $150 before eventually challenging the $300 level.

3. Shock Scenario (Anytime)

A geopolitical disruption, major mining shutdown, investment surge, or technological breakthrough creates a sudden imbalance in an already tight market. Because silver is extremely thinly traded relative to demand, even a modest disruption could trigger a rapid price spike.

Across all three scenarios, the message is clear: a world electrifying at high speed is primed for a supply crunch.

Investor Strategies for a Potential High-Demand Silver Era

Those preparing for the next phase of the silver market may consider:

1. Building a Foundation with Physical Silver

Bars, coins, and IRA-eligible bullion provide stable exposure and long-term security.

2. Watching the Gold-to-Silver Ratio Closely

Declining ratios often mark the strongest periods of silver outperformance.

3. Expecting — and Embracing — Volatility

Silver is historically volatile but tends to advance in powerful, concentrated rallies.

4. Recognizing That Industrial Demand Is Not Fully Priced In

As institutions update demand models for solar, EVs, and tech, valuations may reset higher.

5. Accounting for Ongoing Supply Deficits

Every major forecast points toward deepening shortages through 2030 and potentially beyond.

Silver’s Future May Be Far Bigger Than Expected

With silver already beyond $63 per ounce, the market is beginning to reflect a profound transformation in global demand. The convergence of electrification, renewable energy, advanced technology, and long-term supply constraints is reshaping expectations for how high silver could climb.

If these forces continue to intensify, $300 silver may not be a speculative fantasy — it may be a logical outcome of structural change.

Bullion Hunters remains dedicated to helping investors navigate this historic period with expert insights, transparent pricing, and access to high-quality silver products — all supported by our powerful price comparison tool, ensuring you always find the best possible deals from the most trusted dealers in the industry.

Related reading you may find interesting:

What an Ounce of Silver Can Buy Today: A Market Value Comparison

Can Gold Prices Reach $10,000 an Ounce in 2026?