A Guide to Dollar-Cost Averaging in 2025

In today’s volatile financial markets, investors are looking for ways to build wealth steadily while minimizing risk. One time-tested strategy is dollar-cost averaging (DCA) - a method that can help reduce the emotional and financial stress of investing in gold. In this guide, we’ll explore how DCA works, why it’s especially relevant in 2025, and how it compares to lump-sum investing. Whether you're just getting started or refining your strategy, this article will help you make smarter decisions in your precious metals portfolio.

What Is Dollar-Cost Averaging?

Dollar-cost averaging is a long-term investment strategy where you invest a fixed amount of money into an asset - like physical gold - on a regular schedule, regardless of its price. Instead of trying to time the market, you build your position slowly and systematically.

Key Characteristics of DCA:

- Consistency: You commit to purchasing at regular intervals (weekly, monthly, quarterly).

- Fixed Investment Amounts: You invest the same dollar amount each time, which results in buying more when prices are low and less when prices are high.

- Long-Term Focus: Ideal for building wealth gradually and reducing the impact of short-term volatility.

Why Dollar-Cost Averaging Is Popular Among Gold Investors

Gold’s role as a safe-haven asset has been amplified in 2025 amid inflation, geopolitical tension, and central bank policy shifts. Yet even gold experiences short-term price fluctuations. DCA offers a practical way to navigate these ups and downs.

Benefits of Using DCA in Today’s Market:

- Reduces the Risk of Poor Timing: No need to guess if gold has peaked or bottomed.

- Lowers Emotional Stress: Removes the urge to react impulsively to price swings.

- Enhances Discipline: Encourages consistent saving and investing habits.

- Builds Wealth Over Time: Even small, regular purchases can grow into a strong position.

- Smooths Out Volatility: Buying at multiple price points helps reduce the average cost per ounce over time.

Real-World Example: DCA in Action

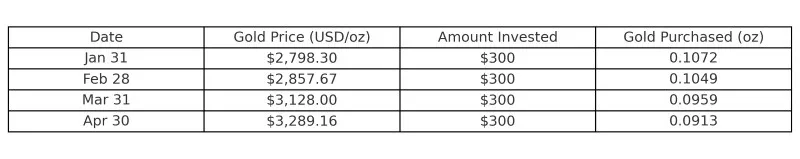

To illustrate how dollar-cost averaging works, let's consider an investor who allocates $300 monthly to purchase gold from January through April 2025. Using the closing gold prices at the end of each month, we can calculate the amount of gold acquired each month and the average cost per ounce over the period.

Monthly Gold Purchases

Total Gold Acquired: 0.1072 + 0.1049 + 0.0959 + 0.0913 = 0.3993 oz

Total Invested: $300 x 4 = $1,200

Average Cost per Ounce: $1,200 / 0.3993 oz = $3,005.76

Analysis

By investing a fixed amount monthly, the investor purchased more gold when prices were lower (January and February) and less when prices were higher (March and April). This strategy resulted in an average purchase price of $3,005.76 per ounce, which is lower than the prices in March and April. Dollar-cost averaging helped mitigate the risk of market volatility and avoided the pitfalls of attempting to time the market.

This example demonstrates how dollar-cost averaging can be an effective strategy for gold investors, especially in fluctuating markets. By consistently investing over time, investors can potentially lower their average cost and reduce the impact of short-term price volatility.

DCA vs. Lump-Sum Investing: Which Is Better for Gold?

There’s no universal answer, but each method serves a different purpose.

Dollar-Cost Averaging (DCA)

Pros:

- Reduces timing risk

- Encourages discipline

- Better for volatile markets

Cons:

- May underperform lump-sum if the asset steadily rises

Lump-Sum Investing

Pros:

- Greater exposure to early gains if prices rise

- Simpler one-time execution

Cons:

- Higher risk if prices drop soon after purchase

- Requires confidence in market timing

Bottom line: If you’re uncertain about gold’s short-term direction, DCA offers a smart, stress-free alternative.

Best Practices for Dollar-Cost Averaging in Gold

To get the most from DCA, follow these key tips:

1. Choose a Regular Investment Schedule

Monthly or biweekly purchases tend to work best for consistency.

2. Decide How Much to Invest

Start with a manageable amount. Even $100/month can grow over time.

3. Stick with Physical Gold

Prioritize reputable gold bullion products like:

4. Track Prices and Trends

Use tools like Bullion Hunters’ live gold spot price chart to monitor market trends and spot buying opportunities.

5. Compare Prices Before Each Purchase

Gold premiums vary widely. Use Bullion Hunters’ powerful tool to compare gold prices across top dealers and find the best deals in real time.

Using Bullion Hunters to Maximize Your DCA Strategy

One of the smartest ways to enhance your DCA strategy is by leveraging Bullion Hunters’ comparison tools. Instead of relying on a single retailer, you can:

- Instantly compare product prices across trusted sellers

- Find the lowest premiums on coins and bars

- Access historical pricing and availability data

- Make more informed decisions on every purchase

Whether you’re buying monthly or weekly, Bullion Hunters ensures you get the most metal for your money - every time.

Is Dollar-Cost Averaging Right for You?

If you’re looking for a low-risk, high-discipline approach to investing in gold, dollar-cost averaging is one of the most effective strategies available. It works particularly well in uncertain markets like we’re seeing in 2025, helping investors smooth out price fluctuations and build a position over time without the stress of market timing.

Whether you’re stacking slowly or building for the future, DCA can help you stay consistent - and stay in the game. And with tools like Bullion Hunters at your fingertips, you can buy smarter, compare better, and invest with confidence.