Platinum’s Bullish Momentum Accelerates

As of June 10, 2025, platinum is trading at $1,225.00 per ounce, continuing a robust rally that has outpaced gold and captured the attention of savvy investors. With over a 15% gain in June alone, platinum's resurgence is being fueled by tightening supply, booming industrial demand - especially from China - and growing recognition of its undervalued status in the precious metals market. Analysts suggest that this trend could signal a prime opportunity for those seeking diversified exposure to high-potential metals.

Platinum Price Snapshot and Historical Performance

- Platinum Price Today (June 2025): $1,225.00 per ounce

- YTD Growth: More than 25% since January

- Historical High: $2,276.00 per ounce (March 2008)

Despite recent gains, platinum remains well below its all-time high, highlighting the potential for further upside in today’s inflation-conscious, supply-constrained global economy.

What’s Driving Platinum’s 2025 Rally?

Supply Disruptions and Market Deficits

- South African Output Drops: South Africa, responsible for roughly 70% of global platinum production, is reporting declining output due to mine closures, labor disputes, and power shortages.

- Recycling Stagnation: Platinum recovered from recycled automotive catalysts and jewelry has declined, with only modest projections for recovery in 2025.

- Widening Deficit: The World Platinum Investment Council forecasts a 2025 supply shortfall of over 850,000 ounces, marking the third consecutive year of global deficits.

Industrial and Jewelry Demand Soars

- Automotive Growth: With hybrid vehicle production increasing, platinum demand for catalytic converters is rebounding strongly, especially as global emissions standards tighten.

- China’s Jewelry Boom: Chinese consumers have driven a 9% increase in platinum jewelry demand this year, adding momentum to an already bullish market.

- Investor Appetite: Platinum investment demand surged by more than 300% in Q1 2025 compared to the previous year, as traders and institutions view it as a hedge against economic volatility and a play on scarcity.

Why Platinum May Still Be Undervalued

Many analysts believe platinum remains deeply discounted compared to its peers - especially gold. The gold-to-platinum ratio, currently hovering around 2.7, is far from historical parity. Platinum is not only rarer than gold but also critical to industrial applications ranging from automotive tech to hydrogen fuel cells.

If platinum holds above key support levels (now well above $1,200), chartists anticipate a technical breakout toward $1,400 in the near term and possibly $3,000+ over the next 12–24 months, especially if supply constraints persist.

Platinum vs. Other Precious Metals: A Strategic Comparison

- Rarity: Platinum is approximately 30 times rarer than gold, enhancing its value from a scarcity standpoint.

- Utility: It plays a vital role in multiple industries - particularly automotive, electronics, and green energy.

- Valuation Gap: Compared to gold, platinum trades at a substantial discount, offering long-term appreciation potential for forward-looking investors.

How to Invest in Platinum Today

Investors interested in platinum have a range of options to consider:

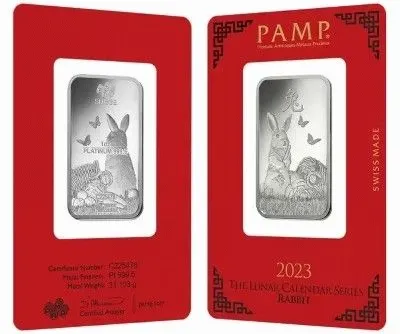

- Platinum Bars: Available in various weights, from fractional sizes to full-ounce bars, produced by refiners like PAMP Suisse, Valcambi, and Credit Suisse.

- Government-Issued Coins: Coins such as the American Platinum Eagle and Canadian Platinum Maple Leaf are widely recognized and valued for their purity and liquidity.

- IRA-Eligible Platinum: Certain platinum products may qualify for inclusion in a Precious Metals IRA, which can offer potential tax advantages for long-term holdings.

- Price Comparison Tools: Platforms like Bullion Hunters allow users to compare dealer pricing, premiums, and availability across multiple retailers - helping buyers make more informed decisions before purchasing.

Is Platinum the Hidden Gem of 2025?

With robust demand, a tightening supply pipeline, and historically low relative pricing, platinum stands out as a compelling opportunity in the evolving 2025 investment landscape. As more investors recognize its strategic value - both as a hedge and a growth asset - platinum could transition from an overlooked metal to a portfolio cornerstone.

Stay ahead of the curve with Bullion Hunters, where we track the trends, analyze the markets, and help you make smarter moves in precious metals.

Another article that may interest you:

Gold’s $10,000 Question: Visionary Forecast or Investment Folklore?