Gold’s Role in Times of Uncertainty

For centuries, gold has served as a bedrock of financial security, protecting wealth through wars, recessions, and inflationary cycles. In modern markets, its reputation as the ultimate safe-haven asset remains as relevant as ever. When currencies weaken, equity markets swing wildly, or global tensions rise, gold consistently attracts capital. For U.S. investors especially, it offers protection against both dollar weakness and systemic shocks that threaten traditional asset classes.

What Is a Safe-Haven Asset?

A safe-haven asset is an investment that preserves or even increases value during times of market stress, providing stability when risk assets such as stocks or corporate bonds falter. Investors flock to these assets in periods of uncertainty—whether sparked by recessions, geopolitical conflict, or inflation—because they offer reliability and liquidity. While safe havens can take different forms, including U.S. Treasury bonds, the Swiss franc, or the Japanese yen, gold stands apart. Unlike paper-based assets, gold carries intrinsic value, is universally recognized, and is not tied to the health of any single government or financial system. Its independence, combined with centuries of trust, cements its role as the ultimate safe-haven asset in both modern and historical contexts.

Gold’s Historical Strength in Crisis

Gold’s safe-haven status isn’t theoretical — history proves it. During the 2008 financial crisis, gold rose nearly 25% in a single year while stocks collapsed. In 2020, amid the COVID-19 pandemic, it surged to record highs above $2,000 per ounce as investors fled uncertainty. Today, with inflation pressures and ongoing geopolitical risks, gold continues to demonstrate its resilience. Analysts note that central bank demand — led by China, India, and Russia — remains a powerful force driving long-term stability.

As Fed Chair Jerome Powell noted recently, “Uncertainty about the economic outlook remains elevated.” Such conditions are precisely when investors turn to gold.

Composition, Purity, and Investment-Grade Assurance

Investment-grade gold bullion typically comes in .999 or .9999 fine purity, whether in coins or bars. This fineness ensures not only intrinsic value but also global recognition. Popular products like the American Gold Eagle (22k alloyed for durability) and the Canadian Gold Maple Leaf (.9999 fine) are trusted worldwide for both purity and liquidity. For investors seeking larger holdings, kilo bars and 10 oz gold bars provide efficiency, while fractional coins allow accessibility for smaller budgets. The universal trust in purity and weight is what makes gold uniquely reliable as a wealth-preservation tool.

Gold vs. Other Assets: Diversification Benefits

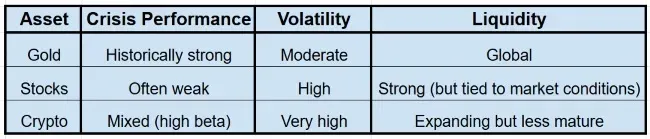

While stocks, real estate, and even cryptocurrencies can generate returns, they also bring volatility. Gold offers something different: balance. In a diversified portfolio, gold often moves inversely to equities and the dollar, cushioning losses elsewhere. In fact, when measured against inflation, gold has maintained its purchasing power for centuries. Unlike fiat currencies, it cannot be printed or devalued by policy shifts. Compared to crypto, gold offers lower short-term volatility and a proven track record in every type of economic storm.

Collector Value and Numismatic Appeal

Gold isn’t just about spot price. Collectors know that certain coins carry significant premiums due to artistry, limited mintages, or historic importance. For example, early American Gold Eagles, Perth Mint Lunar gold coins, and Proof Gold Buffalos often command higher premiums than standard bullion. Certified coins graded by PCGS or NGC assure authenticity and condition, adding further confidence for buyers who want lasting value. This dual nature — investment asset and collectible — gives gold a unique edge over most alternatives.

Looking Ahead: Is $4,000 Gold Possible by the End of 2025?

Markets are already speculating about gold’s next major move. If inflation pressures persist or the Federal Reserve leans further into rate cuts, analysts see the potential for gold to test $4,000 per ounce. At the same time, a stronger U.S. dollar could create short-term dips, as we’ve seen historically. For savvy investors, those dips often provide prime buying opportunities.

Why Shop Popular Gold Bullion with Bullion Hunters

- Save time and money with Bullion Hunters’ powerful price comparison tool.

- Instantly view premiums across multiple trusted dealers to secure the best deal.

- Navigate easily with clear displays that highlight “as low as” pricing.

- Shop confidently knowing all listed dealers are vetted for security and reliability.

- Access top bullion products like Gold Eagles, Maple Leafs, and Buffalos at competitive prices.

A Precious Metal for Every Era

Gold’s enduring appeal lies in its balance of stability, liquidity, and universal recognition. It is simultaneously an inflation hedge, a crisis asset, and a store of generational wealth. While crypto and other alternatives attract attention, gold’s legacy as the ultimate safe-haven remains unmatched.

Will the coming decade cement gold’s dominance at new record highs — or will alternative assets compete for the safe-haven crown? For investors today, the wisest path may be balance: securing tangible bullion through trusted dealers while staying prepared for the next market storm.

Another article that may interest you:

Gold Bars vs. Coins: Which Investment Wins in 2025?