January 12, 2026

Understanding What Tops the World’s Most Valuable Assets

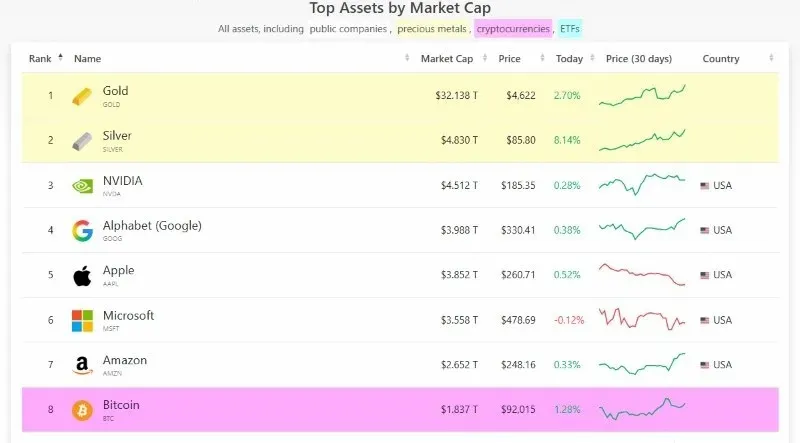

Gold and silver currently occupy the top two positions among all global assets by market capitalization, surpassing the world’s largest publicly traded companies. This ranking reflects how investors worldwide continue to prioritize tangible stores of value amid economic uncertainty. While technology stocks and digital assets often capture headlines, precious metals quietly remain foundational to global wealth.

For investors comparing asset classes, this moment provides an opportunity to better understand how gold and silver are valued—and why their role remains so significant today.

How Market Capitalization Measures Asset Value

Market capitalization represents the total value of an asset in circulation. For companies, it is calculated by multiplying share price by the number of outstanding shares. For precious metals, market cap is based on current spot prices multiplied by estimates of above-ground supply.

This approach allows investors to compare vastly different assets—such as stocks, commodities, and cryptocurrencies—on a single scale. When gold and silver rise to the top, it signals broad and sustained global demand rather than short-term speculation.

Why Gold Remains the World’s Largest Asset

Gold’s standing as the world’s largest asset by market capitalization is rooted in its long-standing role as a trusted store of value, with movements in the price of gold reflecting global demand for stability. Central banks, governments, and private investors consistently turn to gold to help preserve purchasing power during periods of inflation, currency volatility, and geopolitical uncertainty. Because gold carries no counterparty risk and exists outside the traditional financial system, changes in the price of gold often signal broader shifts in investor confidence. These characteristics have made gold a cornerstone of long-term wealth preservation strategies across economies and generations.

Silver’s Dual Identity: Investment and Industry

Silver’s position just behind gold in global asset rankings underscores its unique combination of monetary and industrial significance, with the price of silver influenced by both investor behavior and real-world demand. Investors seek silver during uncertain economic conditions, while industries rely on it for critical applications in solar technology, electronics, medical devices, and electric vehicles. This dual demand structure tightens available supply, making the price of silver particularly responsive to shifts in economic growth and technological adoption. As a result, silver continues to gain prominence within the global asset landscape as both a store of value and an essential industrial resource.

Why This Ranking Matters Right Now

Gold and silver’s dominance comes during a period marked by inflation concerns, rising government debt, and shifting monetary policy expectations. These conditions often push investors toward assets that do not rely on earnings growth or debt expansion.

The rise of precious metals suggests that many market participants are prioritizing stability, durability, and intrinsic value over growth-dependent assets.

What It Means That Metals Outrank Major Corporations

Gold and silver now exceed the market capitalizations of companies like NVIDIA, Microsoft, Amazon, and Google. While these corporations drive innovation and economic growth, their valuations depend on future earnings, regulatory environments, and market sentiment.

Precious metals, by contrast, derive value from scarcity and global trust rather than corporate performance, making them fundamentally different—and complementary—assets within diversified portfolios.

Where Bitcoin Fits Among Global Assets

Bitcoin currently ranks #8 worldwide by market capitalization, placing it among the most valuable assets globally. Often compared to gold due to its limited supply, Bitcoin has gained recognition as a digital alternative for value storage.

However, unlike gold and silver, Bitcoin’s shorter history and higher volatility make it a different type of asset. Many investors view cryptocurrencies as a complement to precious metals rather than a replacement.

Central Bank Influence and Supply Constraints

Central banks continue to play a major role in gold demand, using it to diversify reserves and reduce reliance on fiat currencies. This consistent buying helps support gold’s long-term market value.

Silver faces a different dynamic: much of its supply is consumed in industrial processes and not easily recovered. Combined with limited new mine production, this contributes to tightening availability and long-term price support.

What This Means for Long-Term Investors

Gold and silver’s market capitalization rankings reinforce their role as foundational portfolio assets rather than speculative trades. Their liquidity, global recognition, and independence from financial intermediaries make them valuable tools for diversification.

Investors evaluating asset allocation can use market cap rankings as one data point when comparing physical metals, stocks, and digital assets.

Why Asset Rankings Still Matter

A Practical Lens for Comparing Investments

Gold and silver leading global asset rankings underscores the lasting importance of tangible wealth. While markets evolve and new asset classes emerge, precious metals continue to anchor portfolios through cycles of expansion and uncertainty.

For those comparing how different assets store value over time, market capitalization offers a useful perspective—and gold and silver’s position at the top remains a powerful reminder of their enduring role.

Data table sourced from: companiesmarketcap.com

Related reading you may find interesting:

Why Silver Premiums Stay High and Buybacks Lag Spot Prices