America’s Monumental Gold Milestone

Gold has always fascinated nations, markets, and individuals as the ultimate measure of wealth. In 2025, the United States reached a symbolic threshold: its official gold holdings—261,498,926 troy ounces (≈8,133.5 metric tons)—are now valued at more than $1 trillion for the first time in history, with gold priced near $3,840 per ounce.

Yet on the Treasury’s books, those same reserves are still carried at just $11 billion, based on a statutory valuation frozen in place since 1973. This striking contrast highlights both the enduring importance of America’s gold and the renewed urgency of the question: should the U.S. finally conduct a full, independent audit of Fort Knox?

A $1 Trillion Treasure in Context

The U.S. gold reserves, stored mainly at Fort Knox, the Denver Mint, and West Point, remain virtually unchanged for decades. Yet their modern valuation is staggering: about $1.004 trillion.

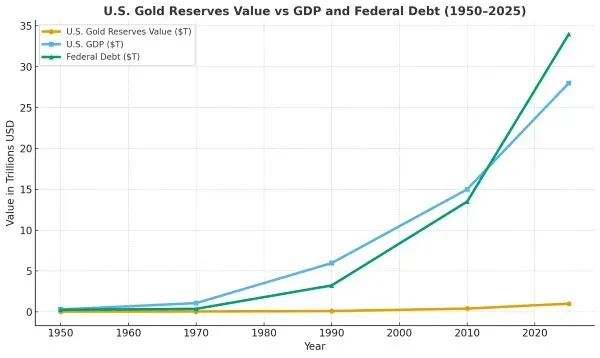

Placed in perspective, however, the reserves represent only a fraction of national finances:

- U.S. GDP (2024 est.): $28 trillion → Gold = ~3.6% of GDP

- U.S. National Debt (2024): $34 trillion → Gold = ~2.95% of debt

Even at the trillion-dollar mark, America’s gold covers only a slim portion of its economic output and obligations.

The Push for Transparency in Washington

Calls for transparency have grown louder. In June 2025, Representative Thomas Massie (R-KY) introduced the Gold Reserve Transparency Act of 2025 (H.R. 3795). If enacted, it would:

- Direct the Government Accountability Office (GAO) to complete a comprehensive audit within one year.

- Require recurring audits every five years.

- Verify the authenticity of the bars, confirm security measures, and identify encumbrances (leases, swaps, pledges).

- Review all gold transactions stretching back half a century.

As of now, the bill remains in committee. Advocates say a trillion-dollar national asset demands public verification. Critics caution that a full assay is costly, complex, and potentially sensitive for national security.

Fort Knox: More Than a Vault

Fort Knox isn’t merely a storage facility; it is a symbol of American strength and stability. Yet comprehensive inspections are exceedingly rare. The last partial audit in the 1970s verified only selected vault compartments, not a complete bar-by-bar assay.

Arguments for an audit:

- A trillion-dollar asset deserves independent verification.

- Greater transparency could reinforce confidence in the U.S. dollar.

- Regular reviews would mirror best practices in corporate governance.

Arguments against:

- Full audits could reveal security vulnerabilities.

- Inspecting millions of bars is expensive and time-consuming.

- Treasury asserts that existing internal reviews are already sufficient.

The $11 Billion Ledger Value Explained

While investors now measure U.S. gold at more than $1 trillion, the federal government continues to record it at about $11 billion. This figure stems from the statutory rate of $42.2222 per ounce, established in 1973 when the dollar’s link to gold was severed. It is not a reflection of what the government paid for its holdings—much of that gold was acquired long before at varying costs—but rather a legal book entry that has not been updated for over five decades. As a result, the official ledger bears almost no resemblance to current market value. For many observers, this massive discrepancy adds weight to calls for an independent audit and perhaps even a revaluation that would better align accounting with reality.

Have U.S. Gold Reserves Changed Since the 1970s?

Another important fact is that America’s gold stockpile has been essentially unchanged since the early 1970s. Key historical points illustrate why:

- Postwar peak to decline: U.S. reserves exceeded 20,000 metric tons in the mid-20th century but were reduced by decades of outflows under the Bretton Woods system.

- 1971 Nixon shock: When dollar convertibility into gold ended in August 1971, foreign redemptions stopped, halting the drain.

- Stabilization in 1973: By then, holdings had dropped to about 8,133 metric tons, where they remain today.

- No new purchases since: Aside from internal transfers between Fort Knox, Denver, and West Point, the United States has neither sold nor added to its reserves in over 50 years.

This reality means that today’s trillion-dollar valuation reflects price appreciation alone, not expansion of the reserve base. The unchanging tonnage underscores both the stability and the mystery of America’s gold holdings.

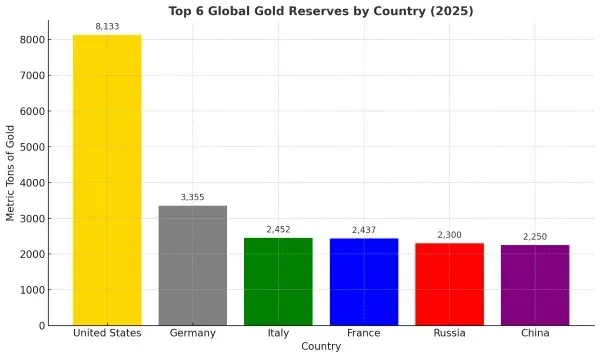

How the U.S. Compares Globally

The United States still holds the world’s largest official gold reserves, but other nations are narrowing the gap:

- United States: ~8,133 metric tons

- Germany: ~3,355 tons

- Italy: ~2,452 tons

- France: ~2,437 tons

- Russia: ~2,300 tons

- China (official): ~2,250 tons, though analysts suggest higher actual holdings

Central banks in Europe and Asia have ramped up gold buying in recent years, often citing a desire to shield themselves from currency volatility and geopolitical risks. America’s trillion-dollar hoard is unmatched in scale, but other nations are making steady progress — and often with more public audits.

Investor Insights: Why It Matters

While the debate around Fort Knox may sound political, it carries real implications for investors:

- Market Sentiment: An audit could stabilize perceptions of U.S. financial credibility.

- Price Impact: Full transparency might dampen speculation — or trigger price spikes if discrepancies appear.

- Portfolio Strategy: Central banks continue to accumulate gold, reinforcing its role in diversification and long-term stability.

Gold’s trillion-dollar status is more than a statistic; it underscores its enduring role as the foundation of trust in global finance.

Could $1 Trillion Trigger Change?

Crossing the trillion-dollar threshold amplifies pressure on lawmakers and institutions. In an era of rising national debt and declining trust in government, tangible reserves like gold carry weight beyond their monetary value.

The core question resonates with both citizens and investors: If U.S. gold reserves are worth more than ever before, shouldn’t we know for certain they are complete, accounted for, and unencumbered?

Transparency, Trust, and the Road Ahead

The valuation of U.S. gold reserves above $1 trillion is more than a milestone—it is a turning point. With the reserves still booked at $11 billion and unchanged in volume since the early 1970s, the mismatch between accounting and reality is too large to ignore. Whether Congress passes the Gold Reserve Transparency Act or not, the debate signals a shift: investors, citizens, and global markets now view transparency as inseparable from financial credibility.

For investors, the conclusion is clear. Gold remains more than a precious metal—it is a bedrock of trust, stability, and long-term value. And as America’s most enduring tangible asset, it deserves the same scrutiny and transparency expected of any trillion-dollar holding.

How Bullion Hunters Empowers Investors

For individual buyers, navigating today’s gold market can feel as complex as national reserve debates. That’s where Bullion Hunters’ powerful price comparison tools come in.

With just a few clicks, investors can:

- Compare real-time prices of gold coins and bars across top dealers.

- Identify the lowest premiums available.

- Save time and money while building a diversified portfolio.

Whether you’re stacking American Gold Eagles, exploring fractional gold, or evaluating bulk bullion bars, Bullion Hunters helps you make smarter, more informed choices in an ever-changing market.

FAQ: U.S. Gold Reserves

Why hasn’t Fort Knox been audited recently?

Only limited inspections have occurred since the 1970s. A full independent audit has never been completed.

How much gold does the U.S. own?

Officially, about 261,498,926 troy ounces (≈8,133.5 metric tons), held at Fort Knox, West Point, and the Denver Mint.

What is the Gold Reserve Transparency Act?

A 2025 congressional proposal (H.R. 3795) requiring comprehensive audits every five years.

Could auditing Fort Knox affect gold prices?

Yes. Full transparency could calm speculation — or reveal issues that push gold prices higher.

Where are U.S. gold reserves stored?

Primarily at Fort Knox, with additional holdings at the West Point Bullion Depository and the Denver Mint.

Why is transparency important?

Independent audits reinforce trust, reassure investors, and confirm the integrity of America’s most valuable tangible asset.